Mutual funds have gained rapid popularity as a good investment vehicle and public at large is attracted towards MF investment, which has variety of schemes and income options offered by Mutual Funds which can suit the financial preferences of all classes of investors, be it Retail, Corporate or Institutional.

The robust performance of the industry comes on the back of growing investor awareness and increased investments in Systematic Investment Plans (SIPs).

AMFI data shows that Indian Mutual Funds have currently about 5.28 crore (52.8 million) SIP accounts through which investors regularly invest in Indian Mutual Fund schemes.

The MF Industry’s AUM has grown from Rs. 17.55 Trillion as on March 31, 2017 to Rs. 37.57 Trillion as on March 31, 2022, more than 2 fold increase in a span of 5 years.

The total number of accounts (or folios as per mutual fund parlance) as on March 31, 2022 stood at 12.95 crore (129.5 million), while the number of folios under Equity, Hybrid and Solution Oriented Schemes, wherein the maximum investment is from retail segment stood at about 10.34 crore (103.4 million). “

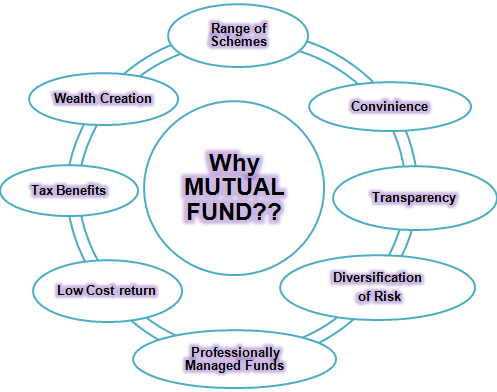

The following benefits, intrinsic to investments in Mutual Funds have inspired greater confidenceamongst the investors :-